Maailman talousfoorumin (WEF) puheenjohtaja Klaus Schwab lipsautti pari vuotta sitten, kuinka tulevaisuudessa maailmassa saattaisi tulla tällainen massiivisen suuri kyberisku, jonka seurauksena koko internet verkot ja sähköverkot lamaantuisivat ja se saisi koronakriisin näyttämään melko pieneltä.From Gab: 'WEF - Klaus Schwab, warning of the next ‘pandemic’, a cyber attack so vast it disconnects the internet.

— sri_chakra (@hetipungava) January 14, 2023

The new internet will only be accessible to those with biometric digital ID.

Almost as if this is a plan 🤷♀️' pic.twitter.com/7Htu9P6vgf

Nyt MTV UUTISET raportoi, että kuinka kuulemma maailmalla on nyt havaittu suuria IT-ongelmia.

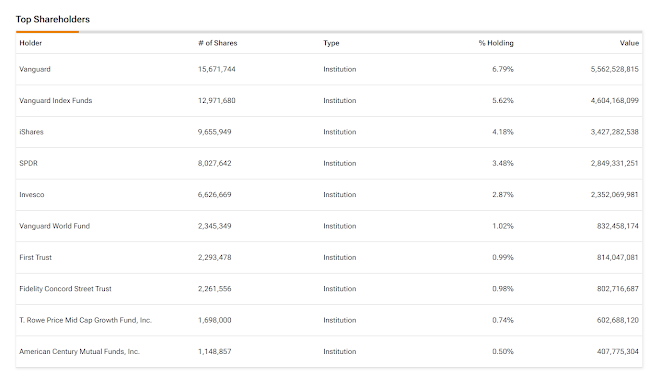

Mutta seurataas sitten rahavanoja, niin mikäs yhtiö siitä kyseisestä tietoturvayhtiöstä omistaa sen 6.79 % ? Vanguard

Tämän näköinen setä (Jack Bogle) sen Vanguard sijoitusyhtiön aikanaan perusti 1. toukokuuta vuonna 1975

Kuitenkin tämän tulevan pankkikriisin keskus tulee olemaan USA:n keskuspankki, koska se on toiminut jo salaisesti myös 1. tammikuuta 1995 lähtien myös Suomenkin valtion talouden hoitajana, koska Suomi luovutti sinne ne valtion valuutanpainamisen oikeudet, koska nämä samat pankkiiriroistot hallinnoivat myös tätä Euroopan Keskuspankkia, jota hallinnoidaan aina salaisesti Republic of Finlandin pankkitiliä New Yorkissa.

================================================================================

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No. 3)*

TeliaSonera AB

----------------

(Name of Issuer)

Ordinary Shares, nominal value SEK 3.20 per share

-------------------------------------------------

(Title of Class of Securities)

**

--------------

(CUSIP Number)

December 31, 2005

-------------------------------------------------------

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to designate the rule pursuant to which this Schedule

is filed:

[ ] Rule 13d-1(b)

[ ] Rule 13d-1(c)

[X] Rule 13d-1(d)

*The remainder of this cover page shall be filled out for a reporting person's

initial filing on this form with respect to the subject class of securities, and

for any subsequent amendment containing information which would alter the

disclosures provided in a prior cover page.

The information required in the remainder of this cover page shall not be deemed

to be "filed" for the purpose of Section 18 of the Securities Exchange Act of

1934 ("Act") or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the

Notes).

** The ordinary shares, nominal value SEK 3.20 per share, of TeliaSonera AB,

which are not traded in U.S. markets, have not been assigned a CUSIP number.

================================================================================

<PAGE>

CUSIP No. The ordinary shares of TeliaSonera AB are not traded in U.S. markets

and have not been assigned a CUSIP number.

--------------------------------------------------------------------------------

1. Names of Reporting Persons. The Republic of Finland

I.R.S. Identification Nos. of above persons (entities only). Not

Applicable

--------------------------------------------------------------------------------

2. Check the Appropriate Box if a Member of a Group

(a) X

(b)

--------------------------------------------------------------------------------

3. SEC Use Only

--------------------------------------------------------------------------------

4. Citizenship or Place of Organization

Finland

--------------------------------------------------------------------------------

5. Sole Voting Power

616,128,221

----------------------------------------------------------

Number of 6. Shared Voting Power

Shares 0

Beneficially

Owned by ----------------------------------------------------------

Each Reporting 7. Sole Dispositive Power

Person With 616,128,221

----------------------------------------------------------

8. Shared Dispositive Power

0

--------------------------------------------------------------------------------

9. Aggregate Amount Beneficially Owned by Each Reporting Person

616,128,221

--------------------------------------------------------------------------------

10. Check if the Aggregate Amount in Row (9) Excludes Certain Shares

[X]

<PAGE>

--------------------------------------------------------------------------------

11. Percent of Class Represented by Amount in Row

(9) 13.2%(***)

--------------------------------------------------------------------------------

12. Type of Reporting Person

OO

----------

(***) Based on 4,675,232,069 ordinary shares, nominal value SEK 3.20 per share,

of TeliaSonera AB outstanding on December 31, 2004 as disclosed by

TeliaSonera AB in its Form 20-F filing with the Securities and Exchange

Commission on April 7, 2005. This total number of shares remains

unchanged. However, the Republic of Finland's percentage of shares has

decreased since December 31, 2004 because of a repurchase program of

TeliaSonera AB. For information on the repurchase program, see Form 6-K

filed with the Securities and Exchange Commission on June 23, 2005

disclosing the completion of the repurchase program decided by the Board

of Directors of TeliaSonera AB on April 26, 2005.

<PAGE>

SCHEDULE 13G

ITEM 1.

(a) Name of Issuer

TeliaSonera AB

(b) Address of Issuer's Principal Executive Offices

Sturegatan 1, S-106 63 Stockholm, Sweden

ITEM 2.

(a) Name of Person Filing

The Republic of Finland

(b) Address of Principal Business Office or, if none, Residence

c/o The Finnish Ministry of Trade and Industry

Aleksanterinkatu 4, FI-00023 Government, Finland

(c) Citizenship

Finland

(d) Title of Class of Securities

Ordinary shares, nominal value SEK 3.20 per share ("Ordinary

Shares")

(e) CUSIP Number

The Ordinary Shares are not traded in U.S. markets and have not

been assigned a CUSIP number.

ITEM 3. If this statement is filed pursuant to Sections 240.13d-1(b) or

240.13d-2(b) or (c), check whether the person filing is a:

Not Applicable

ITEM 4. Ownership.

Provide the following information regarding the aggregate number and percentage

of the class of securities of the issuer identified in Item 1.

(a) Amount beneficially owned: 616,128,221

(b) Percent of class: 13.2%(1)

(c) Number of shares as to which the person has:

(i) Sole power to vote or to direct the vote: 616,128,221

(ii) Shared power to vote or to direct the vote: 0

----------

(1) Based on 4,675,232,069 ordinary shares, nominal value SEK 3.20 per share,

of TeliaSonera AB outstanding on December 31, 2004 as disclosed by

TeliaSonera AB in its Form 20-F filing with the Securities and Exchange

Commission on April 7, 2005. This total number of shares remains

unchanged. However, the Republic of Finland's percentage of shares has

decreased since December 31, 2004 because of a repurchase program of

TeliaSonera AB. For information on the repurchase program, see Form 6-K

filed with the Securities and Exchange Commission on June 23, 2005

disclosing the completion of the repurchase program decided by the Board

of Directors of TeliaSonera AB on April 26, 2005.

<PAGE>

(iii) Sole power to dispose or to direct the disposition of:

616,128,221

(iv) Shared power to dispose or to direct the disposition of:

0

ITEM 5. Ownership of Five Percent or Less of a Class

Not Applicable

ITEM 6. Ownership of More than Five Percent on Behalf of Another Person.

Not Applicable

ITEM 7. Identification and Classification of the Subsidiary Which Acquired the

Security Being Reported on By the Parent Holding Company or Control

Person.

Not Applicable

ITEM 8. Identification and Classification of Members of the Group

The Republic of Finland and The Kingdom of Sweden may be deemed to be a "group"

within the meaning of Rule 13d-5(b)(1) under the Act. See the Shareholders'

Agreement dated March 26, 2002 between The Kingdom of Sweden and The Republic of

Finland contained in Annex C of the Prospectus forming part of the Registration

Statement on Form F-4 (Registration No. 333-100213), filed by Telia AB with the

Securities and Exchange Commission pursuant to the Securities Act of 1933 on

October 1, 2002, as amended by the Amendment to Shareholders' Agreement dated

April 16, 2003 attached as Exhibit 1 to Amendment No. 1 to Schedule 13G filed

with the Securities and Exchange Commission by the Government of Finland on

February 13, 2004 and by the Amendment II to the Shareholders' Agreement dated

October 12, 2004 attached as Exhibit 1 to Schedule 13G filed with the Securities

and Exchanges Commission by the Government of Finland on February 14, 2005 with

respect to TeliaSonera AB.

Pursuant to Rule 13d-5(b)(1) of the Act, the group that may be formed by The

Republic of Finland and The Kingdom of Sweden may be deemed to be the beneficial

owner of 616,128,221 Ordinary Shares beneficially owned by The Republic of

Finland and 2,033,547,131 Ordinary Shares beneficially owned by The Kingdom of

Sweden, representing a total of 2,649,675,352 Ordinary Shares or approximately

56.7% of the Ordinary Shares.(2) However, the Republic of Finland disclaims

beneficial ownership of the Ordinary Shares beneficially owned by The Kingdom of

Sweden.

ITEM 9. Notice of Dissolution of Group

Not Applicable

ITEM 10. Certification

Not Applicable

----------

(2) Based on 4,675,232,069 ordinary shares, nominal value SEK 3.20 per share,

of TeliaSonera AB outstanding on December 31, 2004 as disclosed by

TeliaSonera AB in its Form 20-F filing with the Securities and Exchange

Commission on April 7, 2005. This total number of shares remains

unchanged. However, the Republic of Finland's percentage of shares has

decreased since December 31, 2004 because of a repurchase program of

TeliaSonera AB. For information on the repurchase program, see Form 6-K

filed with the Securities and Exchange Commission on June 23, 2005

disclosing the completion of the repurchase program decided by the Board

of Directors of TeliaSonera AB on April 26, 2005.

<PAGE>

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and correct.

Dated: February 13, 2006

THE REPUBLIC OF FINLAND

By: /s/ Markku Tapio

------------------------------

Name: Markku Tapio

Title: Director General

By: /s/ Arto Honkaniemi

------------------------------

Name: Arto Honkaniemi

Title: Industrial Counsellor UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

TeliaSonera AB

--------------------------------------------------------------------------------

(Name of Issuer)

Ordinary Shares, nominal value SEK 3.20 per share

--------------------------------------------------------------------------------

(Title of Class of Securities)

87960M106**

--------------------------------------------------------------------------------

(CUSIP Number)

December 31, 2004

--------------------------------------------------------------------------------

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to designate the rule pursuant to which this Schedule

is filed:

[ ] Rule 13d-1(b)

[ ] Rule 13d-1(c)

[ X ] Rule 13d-1(d)

*The remainder of this cover page shall be filled out for a reporting person's

initial filing on this form with respect to the subject class of securities, and

for any subsequent amendment containing information which would alter the

disclosures provided in a prior cover page.

The information required in the remainder of this cover page shall not be deemed

to be "filed" for the purpose of Section 18 of the Securities Exchange Act of

1934 ("Act") or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the

Notes).

** While the ordinary shares, nominal value SEK 3.20 per share, of TeliaSonera

AB, which are not traded in U.S. markets, have not been assigned a CUSIP number,

the CUSIP number for the related American Depositary Shares is 87960M106.

<PAGE>

CUSIP No. 87960M106

--------------------------------------------------------------------------------

1. Names of Reporting Persons. The Republic of Finland

I.R.S. Identification Nos. of above persons (entities only).

Not Applicable

--------------------------------------------------------------------------------

2. Check the Appropriate Box if a Member of a Group

(a) X

(b)

--------------------------------------------------------------------------------

3. SEC Use Only

--------------------------------------------------------------------------------

4. Citizenship or Place of Organization

Finland

--------------------------------------------------------------------------------

Number of 5. Sole Voting Power

Shares 641,800,230

Beneficially

Owned by -----------------------------------------------

Each Reporting 6. Shared Voting Power

Person With 0

-----------------------------------------------

7. Sole Dispositive Power

641,800,230

-----------------------------------------------

8. Shared Dispositive Power

0

--------------------------------------------------------------------------------

9. Aggregate Amount Beneficially Owned by Each Reporting Person

641,800,230

--------------------------------------------------------------------------------

10. Check if the Aggregate Amount in Row (9) Excludes

Certain Shares [X]

--------------------------------------------------------------------------------

11. Percent of Class Represented by Amount in Row (9)

13.7%***

--------------------------------------------------------------------------------

12. Type of Reporting Person

OO

-------------------------

*** Based on 4,675,232,069 ordinary shares, nominal value SEK 3.20 per share,

of TeliaSonera AB outstanding on March 31, 2004 as disclosed by TeliaSonera

AB in its Form 20-F filing with the Securities and Exchange Commission on

April 19, 2004.

<PAGE>

SCHEDULE 13G

Item 1.

(a) Name of Issuer

TeliaSonera AB

(b) Address of Issuer's Principal Executive Offices

Sturegatan 1, S-106 63 Stockholm, Sweden

Item 2.

(a) Name of Person Filing

The Republic of Finland

(b) Address of Principal Business Office or, if none, Residence

c/o The Finnish Ministry of Transport and Communications

Etelaesplanadi 16-18, FIN-00131 Helsinki, Finland

(c) Citizenship

Finland

(d) Title of Class of Securities

Ordinary shares, nominal value SEK 3.20 per share ("Ordinary

Shares")

(e) CUSIP Number

The Ordinary Shares are not traded in U.S. markets and have not

been assigned a CUSIP number. However, the CUSIP number for the

related American Depositary Shares is 87960M106.

Item 3. If this statement is filed pursuant to Sections 240.13d-1(b) or

240.13d-2(b) or (c), check whether the person filing is a:

Not Applicable

Item 4. Ownership.

Provide the following information regarding the aggregate number and

percentage of the class of securities of the issuer identified in

Item 1.

(a) Amount beneficially owned: 641,800,230

(b) Percent of class: 13.7%(1)

(c) Number of shares as to which the person has:

(i) Sole power to vote or to direct the vote: 641,800,230

(ii) Shared power to vote or to direct the vote: 0

(iii) Sole power to dispose or to direct the disposition of:

641,800,230

----------------------------------

(1) Based on 4,675,232,069 ordinary shares, nominal value SEK 3.20 per share,

of TeliaSonera AB outstanding on March 31, 2004 as disclosed by TeliaSonera

AB in its Form 20-F filing with the Securities and Exchange Commission on

April 19, 2004.

<PAGE>

(iv) Shared power to dispose or to direct the disposition of: 0

Item 5. Ownership of Five Percent or Less of a Class

Not Applicable

Item 6. Ownership of More than Five Percent on Behalf of Another Person.

Not Applicable

Item 7. Identification and Classification of the Subsidiary Which Acquired

the Security Being Reported on By the Parent Holding Company or

Control Person.

Not Applicable

Item 8. Identification and Classification of Members of the Group

The Republic of Finland and the The Kingdom of Sweden may be deemed

to be a "group" within the meaning of Rule 13d-5(b)(1) under the

Act. See the Shareholders' Agreement dated March 26, 2002 between

The Kingdom of Sweden and The Republic of Finland contained in Annex

C of the Prospectus forming part of the Registration Statement on

Form F-4 (Registration No. 333-100213), filed by Telia AB with the

Securities and Exchange Commission pursuant to the Securities Act of

1933 on October 1, 2002, as amended by the Amendment to

Shareholders' Agreement dated April 16, 2003 attached as Exhibit 1

to Amendment No. 1 to Schedule 13G filed with the Securities and

Exchange Commission by The Government of Finland on February 13,

2004, and by the Amendment II to the Shareholders' Agreement dated

October 12, 2004 attached as Exhibit 1 to this statement.

Pursuant to Rule 13d-5(b)(1) of the Act, the group that may be

formed by The Republic of Finland and The Kingdom of Sweden may be

deemed to be the beneficial owner of 641,800,230 Ordinary Shares

beneficially owned by The Republic of Finland and 2,118,278,261

Ordinary Shares beneficially owned by The Kingdom of Sweden,

representing a total of 2,760,078,491 Ordinary Shares or

approximately 59% of the Ordinary Shares.(2) However, the Republic

of Finland disclaims beneficial ownership of the Ordinary Shares

beneficially owned by The Kingdom of Sweden.

Item 9. Notice of Dissolution of Group

Not Applicable

Item 10. Certification

Not Applicable

------------------------------

(2) Based on 4,675,232,069 ordinary shares, nominal value SEK 3.20 per share,

of TeliaSonera AB outstanding on March 31, 2004 as disclosed by

TeliaSonera AB in its Form 20-F filing with the Securities and Exchange

Commission on April 19, 2004.

<PAGE>

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and correct.

Dated: February 14, 2005

THE REPUBLIC OF FINLAND

By: /s/ Samuli Haapasalo

----------------------------------------

Name: Samuli Haapasalo

Title: Director General UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

------------

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

TeliaSonera AB

----------------

(Name of Issuer)

Ordinary shares, nominal value SEK 3.20 per share

-------------------------------------------------

(Title of Class of Securities)

87960M106**

--------------

(CUSIP Number)

December 31, 2003

-------------------------------------------------------

(Date of Event which Requires Filing of this Statement)

Check the appropriate box to designate the rule pursuant to which this

Schedule is filed:

[ ] Rule 13d-1(b)

[ ] Rule 13d-1(c)

[X] Rule 13d-1(d)

*The remainder of this cover page shall be filled out for a reporting person's

initial filing on this form with respect to the subject class of securities, and

for any subsequent amendment containing information which would alter the

disclosures provided in a prior cover page.

The information required in the remainder of this cover page shall not be deemed

to be "filed" for the purpose of Section 18 of the Securities Exchange Act of

1934 ("Act") or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the

Notes).

**While the ordinary shares, nominal value SEK 3.20 per share, of TeliaSonera

AB, which are not traded in U.S. markets, have not been assigned a CUSIP number,

the CUSIP number for the related American Depositary Shares is 87960M106.

<PAGE>

CUSIP No. 87960M106

--------------------------------------------------------------------------------

1 NAMES OF REPORTING PERSONS

The Republic of Finland

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) Not

Applicable

--------------------------------------------------------------------------------

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) [X]

(b) [ ]

--------------------------------------------------------------------------------

3 SEC USE ONLY

--------------------------------------------------------------------------------

4 CITIZENSHIP OR PLACE OF ORGANIZATION

Finland

--------------------------------------------------------------------------------

NUMBER OF SHARES 5 SOLE VOTING POWER

BENEFICIALLY

OWNED BY EACH 891,800,231

REPORTING PERSON ------------------------------------------------------------

WITH 6 SHARED VOTING POWER

0

------------------------------------------------------------

7 SOLE DISPOSITIVE POWER

891,800,231

------------------------------------------------------------

8 SHARED DISPOSITIVE POWER

0

--------------------------------------------------------------------------------

9 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

891,800,231

--------------------------------------------------------------------------------

10 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES [X]

--------------------------------------------------------------------------------

11 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

19.1%(1)

--------------------------------------------------------------------------------

12 TYPE OF REPORTING PERSON

OO

--------------------------------------------------------------------------------

(1) Based on 4,675,232,069 ordinary shares, nominal value SEK 3.20 per share,

of TeliaSonera AB outstanding on April 30, 2003 as disclosed by TeliaSonera

AB in its 20-F filing with the Securities and Exchange Commission on June

30, 2003.

-2-

<PAGE>

SCHEDULE 13G

Item 1(a) Name of Issuer:

TELIASONERA AB

Item 1(b) Address of Issuer's Principal Executive Offices:

STUREGATAN 1

SE-106 63 STOCKHOLM

SWEDEN

Item 2(a) Name of Persons Filing:

THE REPUBLIC OF FINLAND

Item 2(b) Address of Principal Business Office or, if none, Residence:

C/O THE FINNISH MINISTRY OF TRANSPORT AND COMMUNICATIONS

ETELAESPLANADI 16-18

FIN-00131 HELSINKI, FINLAND

Item 2(c) Citizenship:

FINLAND

Item 2(d) Title of Class of Securities:

Ordinary shares, nominal value SEK 3.20 per share ("Ordinary

Shares")

Item 2(e) CUSIP Number:

The Ordinary Shares, which are not traded on U.S. markets, have

not been assigned a CUSIP number. The CUSIP number for the

related American Depositary Shares is 87960M106.

Item 3. If this Statement is filed pursuant to Sections 240.13d-1(b) or

240.13d-2(b) or (c), check whether the person filing is a:

NOT APPLICABLE

Item 4. Ownership:

(a) Amount beneficially owned: 891,800,231

-3-

<PAGE>

(b) Percent of class: 19.1%<F1>

(c) Number of shares as to which the person has:

(i) Sole power to vote or to direct the vote: 891,800,231

(ii) Shared power to vote or to direct the vote: 0

(iii) Sole power to dispose or to direct the disposition of:

891,800,231

(iv) Shared power to dispose or to direct the disposition

of: 0

Item 5. Ownership of Five Percent or Less of a Class

NOT APPLICABLE

Item 6. Ownership of More than Five Percent on Behalf of Another Person

NOT APPLICABLE

Item 7. Identification and Classification of the Subsidiary Which

Acquired the Security Being Reported on By the Parent Holding

Company or Control Person

NOT APPLICABLE

Item 8. Identification and Classification of Members of the Group:

The Republic of Finland and The Kingdom of Sweden may be deemed

to be a "group" within the meaning of Rule 13d-5(b)(1) under the

Act. See the Shareholders' Agreement dated March 26, 2002 between

The Kingdom of Sweden and The Republic of Finland contained in

Annex C of the Prospectus forming part of the Registration

Statement on Form F-4 (Registration No. 333-100213), filed by

Telia AB with the Securities and Exchange Commission pursuant to

the Securities Act of 1933 on October 1, 2002, as amended by the

Amendment to Shareholders' Agreement dated April 16, 2003

attached as Exhibit 1 to this statement.

Pursuant to Rule 13d-5(b)(1) of the Act, the group that may be

formed by The Republic of Finland and the Kingdom of Sweden may

be deemed to be the beneficial owner of 891,800,231 Ordinary

Shares beneficially owned by The Republic of Finland and

2,118,278,261 Ordinary Shares beneficially owned by The Kingdom

of Sweden, representing a total of 3,010,078,492 Ordinary Shares

or approximately 64.4%<F2> of the Ordinary Shares. However, The

Republic of

---------------

<F1> Based on 4,675,232,069 ordinary shares, nominal value SEK 3.20 per share,

of TeliaSonera AB outstanding on April 30, 2003 as disclosed by TeliaSonera

AB in its 20-F filing with the Securities and Exchange Commission on June

30, 2003.

<F2> Based on 4,675,232,069 ordinary shares, nominal value SEK 3.20 per share,

of TeliaSonera AB outstanding on April 30, 2003 as disclosed by TeliaSonera

AB in its 20-F filing with the Securities and Exchange Commission on June

30, 2003.

-4-

<PAGE>

Finland disclaims beneficial ownership of the Ordinary Shares

beneficially owned by The Kingdom of Sweden.

Item 9. Notice of Dissolution of the Group

NOT APPLICABLE

Item 10. Certifications

NOT APPLICABLE

-5-

<PAGE>

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I

certify that the information set forth in this statement is true, complete and

correct.

Dated: February 13, 2004

THE REPUBLIC OF FINLAND

By: /s/ Samuli Haapasalo

--------------------------------------

Name: Samuli Haapasalo

Title: Director General

-6-

<PAGE>

EXHIBITS

Exhibit Description

1 Amendment to Shareholders' Agreement dated April 16, 2003 between

The Republic of Finland and The Kingdom of Sweden

-7-

<PAGE>

EXHIBIT 1

Dated 16 April 2003

================================================================================

Amendment

to

Shareholders' Agreement

regarding

Telia AB

by and between

The Republic of Finland

and

The Kingdom of Sweden

================================================================================

-8-

<PAGE>

This Amendment to Shareholders' Agreement (this "Amendment") is entered into on

this 16 day of April, 2003 by and between

(1) The Republic of Finland ("Finland");

and

(2) The Kingdom of Sweden ("Sweden").

WHEREAS, Finland and Sweden entered into the Shareholders' Agreement, dated as

of 26 March, 2002 (the "Agreement"), whereby Finland and Sweden agreed on

certain matters relating to the merger of Telia AB and Sonera Corporation;

WHEREAS, Finland and Sweden now desire to make certain amendments to the

Agreement;

NOW, THEREFORE, the parties hereto hereby agree as follows:

1. The following definition is added to Section 1:

"TeliaSonera" means TeliaSonera AB (publ).

2. Section 4.1.2(ii) of the Agreement is hereby replaced by the following:

"Carl Bennett, a current member of the Board of Directors of TeliaSonera,

shall be appointed, and shall serve as, Deputy Chairman of the Board of

Directors of TeliaSonera at least until the closing of the Annual General

Meeting of shareholders of TeliaSonera to be held in 2005";

3. The proviso following directly after Section 4.1.2(v) of the Agreement is

hereby replaced by the following:

"provided, however, that, in connection with the Annual General Meeting of

shareholders of TeliaSonera to be held in 2003, one (1) of the members

referred to in subparagraph (iv) above shall be replaced with one (1) new

independent member who is currently not a member of the Board of Directors

of Sonera or the Board of Directors of Telia to be nominated by the new

Nomination Committee of TeliaSonera in accordance with Section 4.1.3., who

shall serve at least until the closing of the General Meeting of

shareholders of TeliaSonera to be held in 2004"

The remnant of the proviso following directly after Section 4.1.2(v), from

"and provided..." to "the requirements of Section 4.1.1." shall remain

unchanged.

4. Finland and Sweden hereby acknowledge and agree that except as specifically

supplemented and amended, changed or modified hereby, the Agreement shall

remain in full force and effect in accordance with its terms.

-9-

<PAGE>

5. This Amendment shall be governed by and construed in accordance with the

substantive laws of Sweden. Any dispute, controversy or claim concerning

the validity, scope, meaning, construction, application or effect of this

Amendment or the breach, termination or invalidity thereof shall be finally

settled by arbitration in Helsinki in accordance with the rules of the

Finnish Central Chamber of Commerce. Each party to this Amendment shall

appoint one arbitrator and the two arbitrators shall appoint a third

arbitrator who shall be the chairman. The arbitration proceedings shall be

conducted in the English language.

This Amendment has been executed in two (2) identical counterparts, of which

each party to this Amendment has taken one (1).

In Stockholm on 16 April 2003 In Helsinki on 16 April 2003 THE KINGDOM OF SWEDEN

THE REPUBLIC OF FINLAND represented by the Ministry of Industry, represented by

the Ministry of Employment and Communications Transport and Communications

<TABLE>

<S> <C>

/s/ Leif Pagrotsky /s/ Kimmo Sasi

------------------------------------------------------- -----------------------------------------------------

Name: Leif Pagrotsky Name: Kimmo Sasi

Title: Minister for Industry and Trade Title: Minister of Transport and Communications

/s/ Samuli Haapasalo

-----------------------------------------------------

Name: Samuli Haapasalo

Title: Director GeneralUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No. )*

TeliaSonera AB

Ordinary shares, nominal value SEK 3.20 per share

87960M106**

December 31, 2002

Check the appropriate box to designate the rule pursuant to which this Schedule is filed:

o Rule 13d-1 (b)

o Rule 13d-1 (c)

x Rule 13d-1 (d)

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page.

The information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the notes).

**While the ordinary shares, nominal value SEK 3.20 per share, of TeliaSonera AB, which are not traded in U.S. markets, have not been assigned a CUSIP number, the CUSIP number for the related American Depositary Shares is 87960M106.

| 13G | |||||||

| CUSIP No. 87960M106 | |||||||

| 1 | NAMES OF REPORTING PERSONS The Republic of Finland | ||||||

| I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) Not Applicable | |||||||

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP | (a) x | |||||

| (b) o | |||||||

| 3 | SEC USE ONLY | ||||||

| 4 | CITIZENSHIP OR PLACE OF ORGANIZATION | ||||||

| Finland | |||||||

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | |||||||

| 5 | SOLE VOTING POWER 891,800,231 | ||||||

| 6 | SHARED VOTING POWER 0 | ||||||

| 7 | SOLE DISPOSITIVE POWER 891,800,231 | ||||||

| 8 | SHARED DISPOSITIVE POWER 0 | ||||||

| 9 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 891,800,231 | ||||||

| 10 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES | x | |||||

| 11 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11): 19.1%(1) | ||||||

| 12 | TYPE OF REPORTING PERSON OO | ||||||

| (1) | Based on 4,675,232,069 ordinary shares, nominal value SEK 3.20 per share, of TeliaSonera AB outstanding on February 10, 2003 as disclosed by TeliaSonera AB in its filing with the Securities and Exchange Commission pursuant to Rule 425 under the Securities Act of 1933 on February 10, 2003. | ||||||

-2-

SCHEDULE 13G

| Item 1 | (a) | Name of Issuer: | |

| TEIASONERA AB | |||

| Item 1 | (b) | Address of Issuer’s Principal Executive Offices: | |

| MÅRBACKAGATAN 11 SE 123 86 FARSTA SWEDEN | |||

| Item 2 | (a) | Name of Persons Filing: | |

| THE REPUBLIC OF FINLAND | |||

| Item 2 | (b) | Address of Principal Business Office or, if none, Residence: | |

| C/O THE FINNISH MINISTRY OF TRANSPORT AND COMMUNICATIONS ETELÄESPLANADI 16-18 FIN-00131 HELSINKI, FINLAND | |||

| Item 2 | (c) | Citizenship: | |

| FINLAND | |||

| Item 2 | (d) | Title of Class of Securities: | |

| Ordinary shares, nominal value SEK 3.20 per share (“Ordinary Shares”) | |||

| Item 2 | (e) | CUSIP Number: | |

| The Ordinary Shares, which are not traded on U.S. markets, have not been assigned a CUSIP number. The CUSIP number for the related American Depositary Shares is 87960M106. | |||

| Item 3 | If this statement is filed pursuant to §§240.13d-1(b) or 240.13d-2(b) or (c), check whether the person filing is a: | ||

| NOT APPLICABLE | |||

-3-

13G

| Item 4. | Ownership: | |||||

| (a) | Amount beneficially owned: 891,800,231 | |||||

| (b) | Percent of class: 19.1%(1) | |||||

| (c) | Number of shares as to which the person has: | |||||

| (i) | Sole power to vote or to direct the vote: 891,800,231 | |||||

| (ii) | Shared power to vote or to direct the vote: 0 | |||||

| (iii) | Sole power to dispose or to direct the disposition of: 891,800,231 | |||||

| (iv) | Shared power to dispose or to direct the disposition of: 0 | |||||

| Item 5. | Ownership of Five Percent or Less of a Class. | |||||

| NOT APPLICABLE | ||||||

| Item 6. | Ownership of More than Five Percent on Behalf of Another Person. | |||||

| NOT APPLICABLE | ||||||

| Item 7. | Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on By the Parent Holding Company or Control Person. | |||||

| NOT APPLICABLE | ||||||

| Item 8. | Identification and Classification of Members of the Group. | |||||

| The Republic of Finland and The Kingdom of Sweden may be deemed to be a “group” within the meaning of Rule 13d-5(b)(1) under the Act. See the Shareholders’ Agreement dated March 26, 2002 between The Kingdom of Sweden and The Republic of Finland contained in Annex C of the Prospectus forming part of the Registration Statement on Form F-4 (Registration No. 333-100213), filed by Telia AB with the Securities and Exchange Commission pursuant to the Securities Act of 1933 on October 1, 2002. | ||||||

| Pursuant to Rule 13d-5(b)(1) of the Act, the group that may be formed by The Republic of Finland may be deemed to be the beneficial owner of 891,800,231 Ordinary Shares beneficially owned by The Republic of Finland and 2,118,278,261 Ordinary Shares beneficially owned by The Kingdom of Sweden, representing a total of 3,010,078,492 Ordinary Shares or approximately 64.4%(2) of the Ordinary Shares. However, The Republic of Finland disclaims beneficial ownership of the Ordinary Shares beneficially owned by The Kingdom of Sweden. | ||||||

| Item 9. | Notice of Dissolution of Group. | |||||

| NOT APPLICABLE | ||||||

| (1) | Based on 4,675,232,069 ordinary shares, nominal value SEK 3.20 per share, of TeliaSonera AB outstanding on February 10, 2003 as disclosed by TeliaSonera AB in its filing with the Securities and Exchange Commission pursuant to Rule 425 under the Securities Act of 1933 on February 10, 2003. | |||||

| (2) | Based on 4,675,232,069 ordinary shares, nominal value SEK 3.20 per share, of TeliaSonera AB outstanding on February 10, 2003 as disclosed by TeliaSonera AB in its filing with the Securities and Exchange Commission pursuant to Rule 425 under the Securities Act of 1933 on February 10, 2003. | |||||

-4-

13G

| Item 10. | Certifications. | ||

Not applicable. | |||

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Dated: | February 14, 2003 |

| THE REPUBLIC OF FINLAND | |

| By: | /s/ Kimmo I. Sasi |

| Name: | Kimmo I. Sasi |

| Title: | Minister of Transport and Communications |

| By: | /s/ Samuli Haapasalo |

| Name: | Samuli Haapasalo |

| Title: | Director-General |

As filed with the Securities and Exchange Commission on October 16, 2008

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-6

REGISTRATION STATEMENT

under

THE SECURITIES ACT OF 1933

For Depositary Shares Evidenced by American Depositary Receipts

of

TELIASONERA AB

(Exact name of issuer of deposited securities as specified in its charter)

N/A

(Translation of issuer’s name into English)

Sweden

(Jurisdiction of incorporation or organization of issuer)

THE BANK OF NEW YORK MELLON

(Exact name of depositary as specified in its charter)

One Wall Street, New York, N.Y. 10286

Telephone (212) 495-1727

(Address, including zip code, and telephone number, including area code, of depositary’s principal executive offices)

The Bank of New York Mellon

ADR Division

One Wall Street, 29th Floor

New York, N.Y. 10286

(212) 495-1784

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Peter B. Tisne, Esq.

Emmet, Marvin & Martin, LLP

120 Broadway

New York, New York 10271

(212) 238-3010

It is proposed that this filing become effective under Rule 466

[X] immediately upon filing

[ ] on (Date) at (Time)

If a separate statement has been filed to register the deposited shares, check the following box. [ ]

CALCULATION OF REGISTRATION FEE

Title of each class | Amount to be registered | Proposed | Proposed | Amount of registration fee |

American Depositary Shares evidenced by American Depositary Receipts, each American Depositary Share representing Two (2) Shares of Common Stock, No Par Value, of Teliasonera AB. | 100,000,000 American Depositary Shares | $0.05 | $5,000,000 | $196.50 |

(1)

Estimated solely for the purpose of calculating the registration fee. Pursuant to Rule 457(k), such estimate is computed on the basis of the maximum aggregate fees or charges to be imposed in connection with the issuance of American Depositary Receipts evidencing American Depositary Shares.

The prospectus consists of the proposed form of American Depositary Receipt filed as Exhibit 1 to this Registration Statement which is incorporated herein by reference.

PART I

INFORMATION REQUIRED IN PROSPECTUS

Cross Reference Sheet

Item- 1 Description of Securities to be Registered

Location in Form

of Receipt Filed

Item Number and Caption

Herewith as Prospectus

1.

Name and address of depositary

Introductory Article

2.

Title of American Depositary

Face of Receipt, top

Receipts and identity of

center

deposited securities

Terms of Deposit:

(i) The amount of deposited

Face of Receipt, upper

securities represented by

right corner

one unit of American

Depositary Receipts

(ii) The procedure for voting,

Articles number

if any, the deposited securities

7 and 12

(iii) The collection and

Articles number

distribution of dividends

8 and 13

(iv) The transmission of

Article number 7

notices, reports and

proxy soliciting material

(v) The sale or exercise of rights

Articles number 4 and 8

(vi) The deposit or sale of

Articles number

securities resulting

8 and 11

from dividends, splits

or plans of reorganization

(vii) Amendment, extension or

Article number 13

termination of the deposit agreement

(viii) Rights of holders of

Article number 2

Receipts to inspect the transfer

books of the depositary and the

list of holders of Receipts

(ix) Restrictions upon the right

to deposit or withdraw the underlying

Articles, number 1,3,

securities

11, 15, and 16

(x) Limitation upon the liability of

Articles number 4, 5, 10,

of the depositary

and 12

Item- 2

Available Information

Public reports furnished

Article number 7

by issuer.

Part II- Information Not Required in Prospectus.

Item-3

Exhibits

1.

Form of Deposit Agreement – The Deposit Agreement relating to the American Depositary Receipts registered hereunder is contained in the form of Receipt itself, which is filed herewith as Exhibit 1.

4.

Opinion of Emmet, Marvin & Martin, LLP, counsel for the Depositary, as to legality of the securities to be registered. – Filed herewith as Exhibit 4.

5.

Certification under Rule 466. – Filed herewith as Exhibit 5.

Item-4

Undertakings

(a)

The Depositary hereby undertakes to make available at the principal office of the Depositary in the United States, for inspection by holders of the ADRs, any reports and communications received from the issuer of the deposited securities which are both (1) received by the Depositary as the holder of the deposited securities, and (2) made generally available to the holders of the underlying securities by the issuer.

(b)

If the amounts of fees charged are not disclosed in the prospectus, the Depositary undertakes to prepare a separate document stating the amount of any fee charged and describing the service for which it is charged and to deliver promptly a copy of such fee schedule without charge to anyone upon request. The Depositary undertakes to notify each registered holder of an ADR thirty days before any change in the fee schedule.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that all the requirements for filing on Form F-6 are met and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New York, State of New York, on October 16, 2008.

Legal entity created by the agreement for this

issuance of American Depositary Receipts for

Common Stock, No Par Value, of Teliasonera AB.

By: The Bank of New York Mellon,

As Depositary

By: /s/ Michael F. Finck

Name: Michael F. Finck

Title: Managing Director

INDEX TO EXHIBITS

Exhibit

Number

1

Form of Deposit Agreement relating to the American Depositary Receipts registered hereunder is contained in the form of American Depositary Receipt itself.

4

Opinion of Emmet, Marvin & Martin, LLP, counsel for the Depositary, as to the legality of the securities being registered.

5

Certification under Rule 466.